in partnership

We change lives so all can thrive

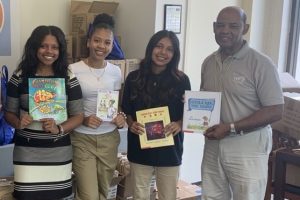

United Way of Westchester and Putnam mobilizes strategic partnerships and leverages resources to create a more equitable community by advancing education, financial stability, and health initiatives. These include the 211 Helpline, the Ride United Last Mile food delivery program, the Education United After School program, the United2Read early literacy program for preschoolers, the Essential Goods for Basic Needs program, and of course, grants and other investments in support of the programs offered by its nonprofit partners. Through these efforts, United Way provides a hand up to tens of thousands of individuals and families annually.

Employee Giving Form

"*" indicates required fields

United in Partnership Packet

The United in Partnership packet offers an insightful overview of United Way’s critical work in Westchester and Putnam counties. It includes the latest impact statistics, heartfelt testimonials from assisted residents, a comprehensive list of community partners, and more.

Workplace Donation Questions

For questions about workplace donations or workplace campaigns, please contact Development Coordinator Sean Walsh at swalsh@uwwp.org or 914-688-1702.

Volunteer Opportunities

Learn More about United Way’s diverse range of hands-on volunteer opportunities, whether you’re an individual or part of a group.

More Ways to Give

Workplace & Employee Giving

United Way gratefully partners with hundreds of organizations across Westchester and Putnam counties. Through employee giving campaigns, corporate donations, matching programs, grants, sponsorships, and volunteerism, these collaborations strengthen our community and create lasting impact.

Donor-Advised Fund

Planned giving opportunities allow donors to make significant, long-term commitments to United Way which align with individual planning goals. There are several ways to plan a gift to United Way, including: a planned estate gift; bequests; naming United Way as a beneficiary on an insurance policy or retirement plan; and/or establishing a charitable trust benefiting United Way.

Stock Transfer

Donate appreciated stock, bonds or mutual funds. Donating stock that has appreciated for more than a year, you are actually giving 20 percent more than if you sold the stock and then made a cash donation by avoiding capital gains taxes. Plus, you are still eligible to deduct the full fair-market value of the asset you donated from your income taxes, up to the overall amount allowed by the IRS.

Estate Planned Giving

Planned giving opportunities allow donors to make significant, long-term commitments to United Way which align with individual planning goals. There are several ways to plan a gift to United Way, including: a planned estate gift; bequests; naming United Way as a beneficiary on an insurance policy or retirement plan; and/or establishing a charitable trust benefiting United Way.

Planned Giving

Planned giving opportunities allow donors to make significant, long-term commitments to United Way which align with individual planning goals. There are several ways to plan a gift to United Way, including: a planned estate gift; bequests; naming United Way as a beneficiary on an insurance policy or retirement plan; and/or establishing a charitable trust benefiting United Way.

IRA Charitable Rollovers

For retirees who’ve accumulated significant savings in their tax-deferred accounts, qualified charitable distribution allow individuals age 70½ and older to make tax-free donations directly from an IRA to a qualified charity, potentially satisfying all or part of their annual required minimum distributions.

United Way of Westchester and Putnam is a 501(c)(3) organization | EIN 13-1997636

Donations made to United Way of Westchester and Putnam are tax deductible to the extent permitted by law.